Finance sector backs firms in Huangshan city

Huangshan city in East China's Anhui province is providing companies of all sizes with financial services including support policies, investment funds, financial guarantees, debt-equity financing and 4,321 government-bank cooperation modes.

There are 10 billion yuan ($1.5 billion) in investment funds for industrial development in support of micro and small enterprises in Huangshan.

Eight funds with a total scale of over 4 billion yuan have been allocated for small and medium-sized specialized enterprises in Anhui province.

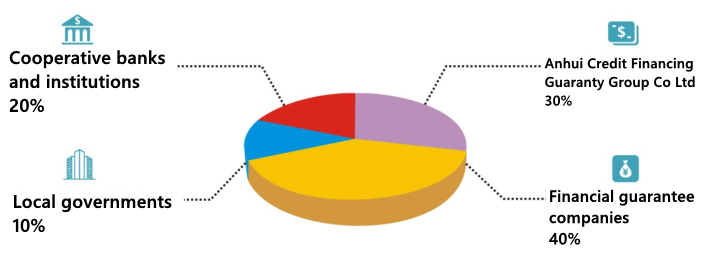

The government-bank cooperation initiative, aimed at supporting micro and small enterprises, refers to financial guarantee companies, Anhui Credit Financing Guaranty Group Co Ltd, cooperative banks and institutions, and local governments.

They are taking on credit risks in the proportion of 40 percent, 30 percent, 20 percent and 10 percent, respectively, for single household loan guarantee businesses of less than 20 million yuan. There are currently 22 cooperative banks and institutions, 880 enterprises benefiting from the policy and 5.8 billion yuan in the balance.